1) First sort all medical bills into stacks by “name of provider.”

2) Next arrange each stack in order by “date of service.”

3) Then search for duplicate bills and discard them as unnecessary, keeping only one original.

4) Gather all EOBs (explanations of benefits) and separate primary EOBs from secondary EOBs if you have dual coverages. Organize EOBs by “date paid” or “date processed.”

5) Create file folders to store the medical bills (you may find it necessary to have a separate file for each medical provider).

6) Create a file folder for the Explanations of Benefits (Primary and Secondary, as required).

7) You may wish to create additional folders for insurance policies, claim forms and written correspondence.

8) Keep a detailed telephone conversation log, as well.

Using the Claim Navigator Spreadsheet

1) Section 1: Medical Services and Charges…..First take only the stack of medical bills and

enter each one on the spreadsheet listing the date of service, the provider of service, the

type of service and the amount charged. These actions complete Section 1 of the Claim

Navigator spreadsheet. Depending on volume of bills, several spreadsheets may be required.

2) Section 2: Response from Insurances…..Next review each primary EOB. On each EOB you

will be able to identify transactions that correspond to the medical bill information listed in

Section 1. The date of service, the provider’s name, the type of service and the amount of

charge found on the EOB will all match identically with an entry you made in Section 1.

Once this match is made you then enter the required information as prompted

by Claim Navigator.

a) Date Paid/Processed

b) PPO Discount/Adjustment

c) Amount Allowed

d) Amount Paid

3) Section 3: Summary Recap…This section helps calculate what you owe and defines

why you owe. The difference between what insurance “allowed” and what insurance

“paid” determines what you owe. The column “Reason I Owe” allows you to make a

notation as to whether your payments are a result of co-pays, co-insurance, deductibles

or some other reason. You can then record when you paid and how you paid.

Once your backlog of bills and EOBs have been organized and recorded on the Claim Navigator

spreadsheet, it is important to keep current by using Claim Navigator just as often as you

receive new bills and EOBs.

Helpful Hints

CAUTION: There is no single standardized way to claim benefits. Dozens of insurance companies and thousands of medical providers, all operating in slightly different manners, force us all to be adaptable. CLAIM NAVIGATOR will assist and give helpful hints along the way.

- The suggested file folders are important because throughout the claim process it is vital that you be able to easily find the papers you are seeking. Organization is the key!

- Keep all files neat and orderly

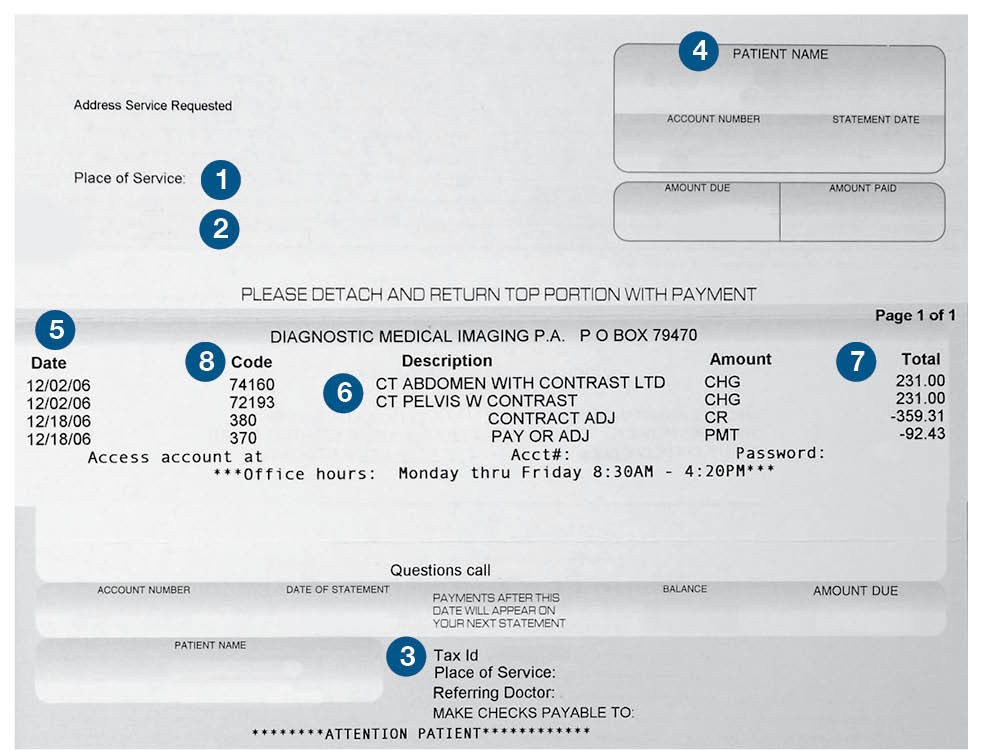

- Not all medical bills look alike but they all must have 8 identifiable items (see: Understanding Your Medical Bills)

- Do not prejudge whether you believe an expense to be eligible. Submit copies of all expenses and let your Insurance company make the determination.

- Your medical providers will most often submit claims on your behalf. If a claim form is required typically you will need to submit only one per year.

- Call on the status of your claim after 30 days.

- Empty spaces on your spreadsheet indicate that you need to take action.

- Multiple spreadsheets may be necessary. Number them accordingly on the front page.

- Begin a new series of spreadsheets for each new calendar year.

- The “Amount I Owe” column in Section 3 calculates your annual out-of-pocket expenses when filing taxes.

- Discounts/Adjustments are given for different reasons.The most common discount is given for utilizing a PPO provider when your plan offers this incentive. You may also receive adjustments for prompt payments or fee negotiations.

- Don’t confuse discounts with Reasonable & Customary (R&C) fee reductions.These reductions are not considered discounts.

You are responsible for paying these reductions. - When your insurance company sends a payment directly to the provider, your claim navigator spreadsheet will help you

calculate your balance due. However, if your insurance company sends a payment directly to you, then you will owe

that amount to the provider plus the balance due as calculated by your claim navigator spreadsheet.

Understanding Your Medical Bills

In order for insurance companies to process your claims

promptly and accurately the bills must include the following;

1) Name of medical provider

2) Address of medical provider

3) Medical provider’s Tax ID number

4) Name of patient

5) Date of service

6) Type of service (current procedural terminology)

7) Cost of service

8) Diagnosis Code – ICD (International Classification Diseases)